You would like to become an owner, but you wonder where to start to realize your project? This article summarizes five minutes of reading all the steps to get to the property you want.

Read More: Real Estate Tips for Buyers

1. Evaluate your borrowing capability

Estimate how much your financial institution gives you a loan to buy your property. By analyzing your financial record, your consultant can help you assess your borrowing capacity. You can also do this by using an online calculator.

2. Determine your down payment

Evaluate the initial amount you will deposit when granting the loan.

Why make a down payment?

The down payment reduces the amount of your loan and reduces the interest payable on your payments. It is important to assess your needs and your budget before determining the amount of your down payment.

How much do you have?

Do you have at least 20% of the purchase price? If 20% of the down payment is paid by you or more of the purchase price of your home, you may be eligible for a conventional loan and avoid mortgage default insurance fees.

Do you think twenty percent of the purchase price is out of reach? When mortgage financing is more than 80% of the property’s value, banks are required by law to purchase mortgage default insurance from Canada Mortgage and Housing Corporation (CMHC) or Genworth Canada. In this case, a mortgage insurance premium is payable1, and this can be added to the sum of the financing. The lesser the down payment, the higher the premium.

How to raise your funds?

Your funds could come from your cash flow, your investments, a donation, an inheritance, or your RRSP.

Have you considered the Home Buyers’ Plan 2 (HBP)? The HBP is a federal government program designed to facilitate household access to homeownership. If you have registered investments (RRSPs), you could benefit from the HBP by withdrawing up to $ 35,000 from your RRSP and using it as a down payment for your property.

- Your withdrawal is not taxable.

- You start repaying the amount withdrawn from your RRSPs from the 2nd year following your withdrawal.

- You have 15 years to repay your entire withdrawal.

You don’t have $ 35,000 in your RRSP, but want to take full advantage of the HBP? An RRSP loan could help you; talk to your advisor.

3. Plan for additional costs

Some additional expenses related to the purchase of a house are to be expected. Of these, here are a few that are worth considering:

Mortgage transaction fees

- Inspection and evaluation fees

- Mortgage loan insurance premium tax for properties in Quebec and Ontario

Property taxes

- Municipal and school taxes

- The real estate transfer tax in Quebec (welcome tax)

- Adjustment of property taxes paid in advance by your seller

Other expenses

- Moving costs

- Home insurance costs

- Development costs (painting, decoration, etc.)

- Service charges (electricity, heating, etc.)

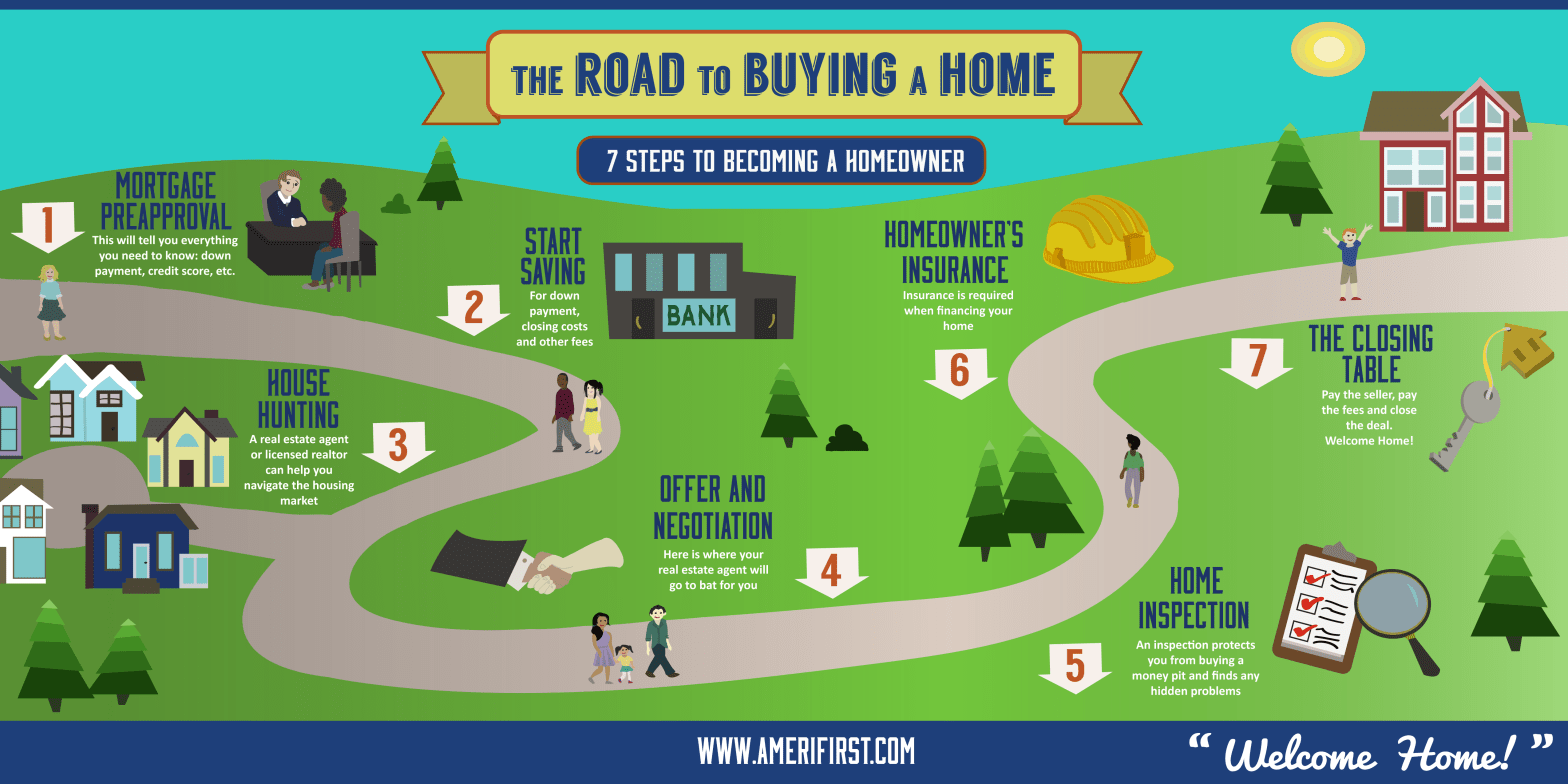

4. Apply for a mortgage pre-authorization

To increase your bargaining power and give credibility to your offer to purchase, apply for a mortgage pre-approval online or from your advisor before starting the search for your property. This will allow you to establish your borrowing capacity, to certify the sum of the mortgage that you can take a price range of accessible properties will be defined to better frame your approach – and even to guarantee the proposed interest rate. By the bank for 90 days.

5. Find your property

You can start your research! What type of home will you choose? Will you be living in the proper city or the countryside? Will you buy a new house or an existing house? Here are some important questions you need to answer.

You can do your research or hire a real estate agent who can help you find an existing home. If you buy a new house, you will have to deal directly with the builder (or with his sellers).

6. Make your offer to purchase

The proposal to buy is a document bringing together all the information necessary to conclude the sale agreement. Your real estate agent, your notary * or your lawyer, will write it up. The document will be include, among other things, the following information:

- The purchase price

- The date of transfer of ownership

- The goods included and excluded in the transaction

- The conditions relating to the offer to purchase (inspection, etc.)

You may need to adjust your offer after a seller’s counter-offer, i.e., revise your terms so that both parties are satisfied.